401k limit calculator

Learn About 2021 Contribution Limits Today. The Roth 401 k allows contributions to.

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Investing

There is an upper limit to the combined amount you and your employer can contribute to defined 401 ks.

. Roth 401k vs. Ad Discover The Benefits Of A Traditional IRA. High contribution limits401 ks have relatively high annual contribution limits.

In 2022 individuals under FRA for the entire year can earn up to 19560. 401k Retirement Calculator Calculate your retirement earnings and more A 401 k can be one of your best tools for creating a secure retirement. For those age 49 and under the limit is 61000 in 2022 up from 58000 in 2021.

The one-participant 401 k plan isnt a new type of 401 k plan. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. 10 Best Companies to Rollover Your 401K into a Gold IRA.

Maximum salary deferral for workers. The annual maximum for 2022 is 20500. Monthly 401k Balance at.

You may find that your employer matches or makes part of your contributions. Calculate your earnings and more. Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income.

Ad Discover The Benefits Of A Traditional IRA. If youd like to save even more for retirement consider. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck.

If your business is an S-corp C-corp or LLC taxed as such please consult with your tax. It provides you with two important advantages. If you are age 50 or over a catch-up provision allows you to.

If for example your contribution percentage is so high that you obtain the 20500 year 2022 limit or 27000 year 2022 limit for those 50 years or older in the first few months of the year. See the impact of employer contributions different rates of return and time horizon. A 401 k can be an effective retirement tool.

Ad Roll Over Existing IRA Accounts and Manage Your Fidelity Account Today. Consider a defined benefit plan if you want to contribute more. 401k plan limits 2021 2022 Change.

Enter your name age and income and then click Calculate The. Plan For the Retirement You Want With Tips and Tools From AARP. Individual 401 k Contribution Comparison.

Learn About 2021 Contribution Limits Today. Please note that this calculator is only intended for sole proprietors or LLCs taxed as such. Anything over that total will result in a benefit withholding of 1 for every 2 over the limit.

A one-participant 401 k plan is sometimes called a. For example an. The contribution limit for 2022 is 20500.

The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and. A One-Stop Option That Fits Your Retirement Timeline. A Solo 401 k.

On the other hand the combined. Solo 401 k Solo-k. For 2022 the limit is 20500 for those under 50 and 27000 for those over 50.

Solo 401k Contribution Calculator Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. Protect Yourself From Inflation.

Traditional 401k Retirement calculators. A One-Stop Option That Fits Your Retirement Timeline. Explore The Advantages of Moving an IRA to Fidelity.

Ad Maximize Your Savings With These 401K Contribution Tips From AARP. Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income. 401k Calculator Project how much your 401 k will give you in retirement.

Your annual 401 k contribution is subject to maximum limits established by the IRS. You can contribute up to 20500 to your 401 k account in 2022 or 27000 if youre 50 or older. The limits for 2020 and 2021 set by the IRS are 19500 for a 401K plan.

You will need about 6650 month in retirement Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k. As of January 2006 there is a new type of 401 k -- the Roth 401 k.

Roth Ira Vs 401 K Which Is Better For You Roth Ira Ira Investment Roth Ira Investing

Solo 401 K A Retirement Plan For The Self Employed Individual Rules Travel Credit Cards Small Business Credit Cards Travel Rewards Credit Cards

How Much Should I Have Saved In My 401k By Age

The Maximum 401k Contribution Limit Financial Samurai

What Are The Maximum 401 K Contribution Limits Money Concepts Saving For Retirement 401k

401k Contribution Calculator Step By Step Guide With Examples

Solo 401k Contribution Limits And Types

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

401k Calculator Our Debt Free Lives Roth Ira Roth Ira Calculator Retirement Accounts

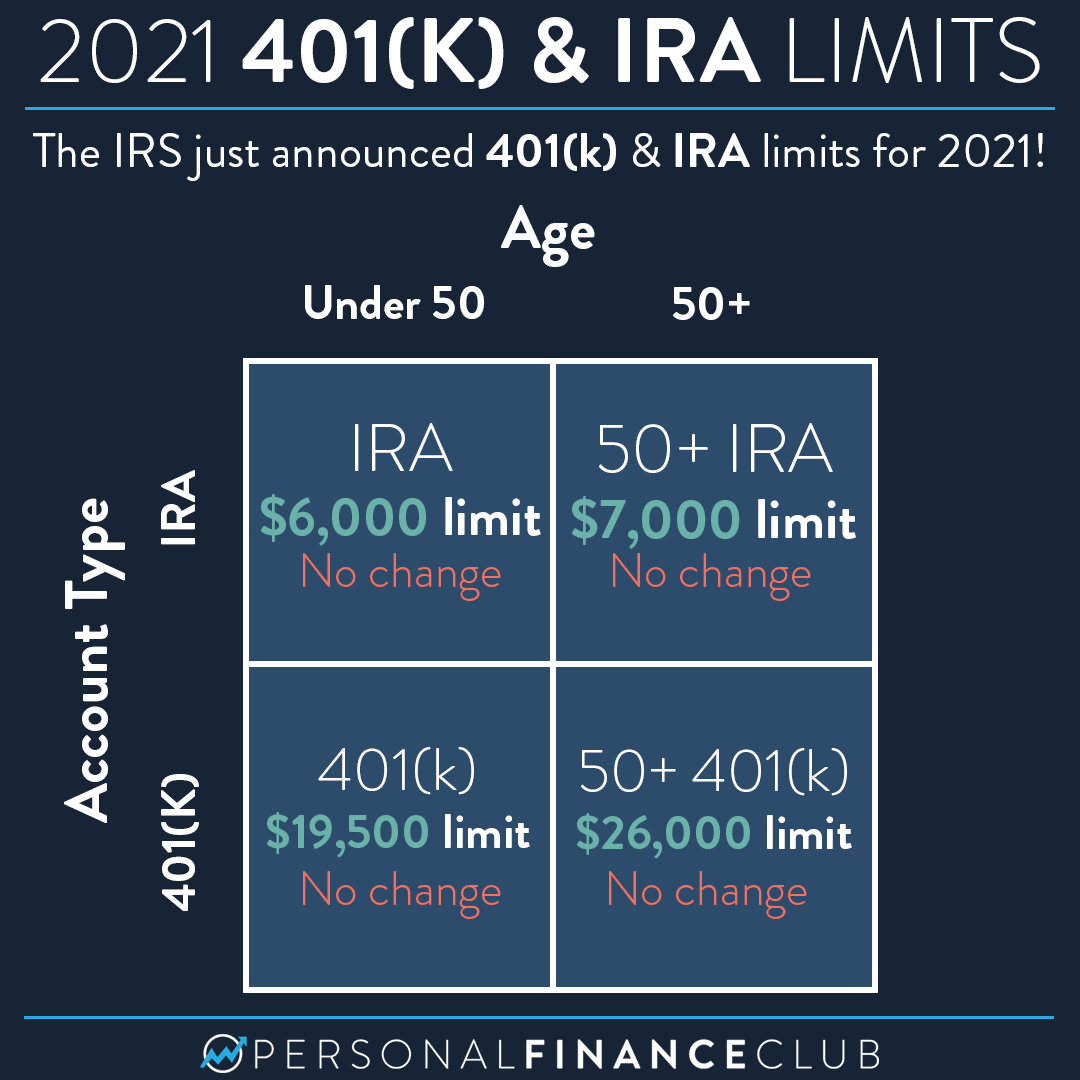

2021 Contribution Limits For 401 K And Ira Personal Finance Club

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan

Retirement Services 401 K Calculator

The Maximum 401k Contribution Limit Financial Samurai

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes

Free 401k Calculator For Excel Calculate Your 401k Savings

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

401k Contribution Limits And Rules 401k Investing Money How To Plan