401k contribution tax savings calculator

Ad Find Tips From AARP to Help You Understand How Much You Can Contribute to 401k Plans. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck.

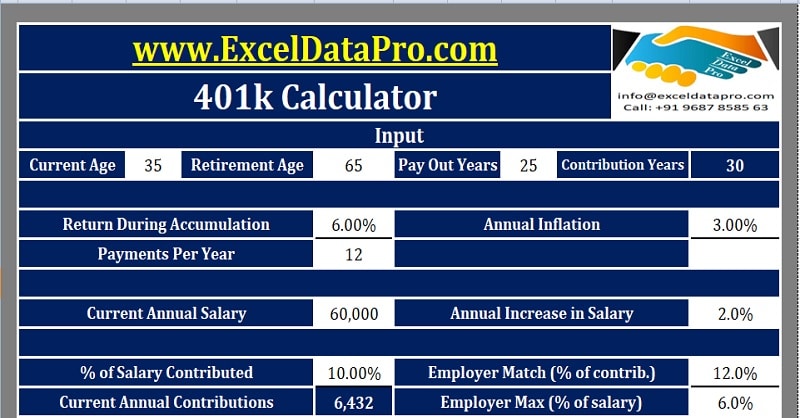

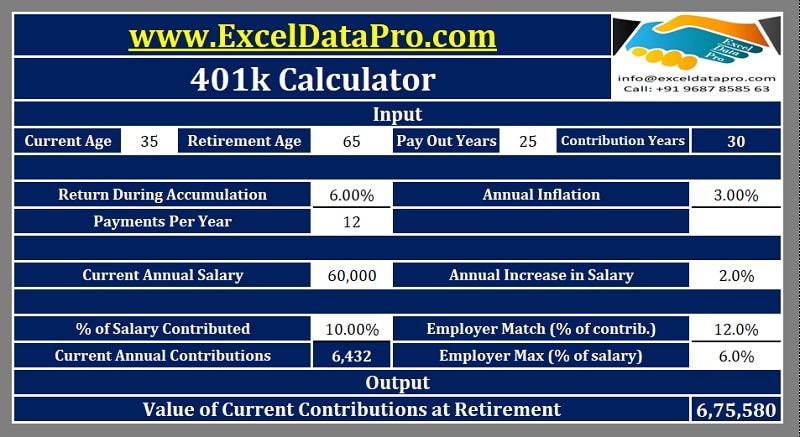

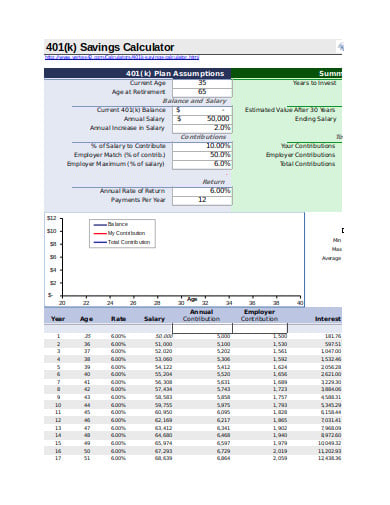

Download 401k Calculator Excel Template Exceldatapro

Ad Discover The Traditional IRA That May Be Right For You.

. Use this calculator to see how increasing your contributions to a. Learn About Contribution Limits. Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings.

A 401 k Contribution calculator will help one to calculate the contribution that will be made by the individual and the employer contribution as well depending upon the limits. For some investors this could prove. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings.

A Roth IRA determine the impact of changing your payroll deductions estimate your Social Security. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Many employers provide matching contributions to your account which can range from 0 to 100 of your contributions.

401k Retirement Calculator Calculate your retirement earnings and more A 401 k can be one of your best tools for creating a secure retirement. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Ad Discover The Traditional IRA That May Be Right For You.

Inform your decisions explore your options and find ways to get the most from your 401k 401k Contribution Calculator Contributing to your workplace. Learn About Contribution Limits. Compare 2022s Best Gold IRAs from Top Providers.

Contributions to a 401k are made as pre-tax deductions during payroll and the dividends interest and capital gains of the 401k all benefit. This calculator has been updated to. If you dont have data ready.

401k donations are usually paid out at the end of this calendar year. To get the most out of this 401 k calculator we recommend that you input data that reflects your retirement goals and current financial situation. Reviews Trusted by Over 20000000.

401k contribution calculator parameters. It provides you with two important advantages. Mark your calendar now.

A 401k Plan is an employer-sponsored retirement plan that comes with impactful tax advantages. In 2022 you can contribute 20500 to a 401 k. 848 With Contributions Tax Payable 4241 Marginal Tax Bracket 12 Effective Tax Rate 848 Results Actual Cost Of Pre-Tax Contributions 0 Taxes Saved 0 The results provided are an.

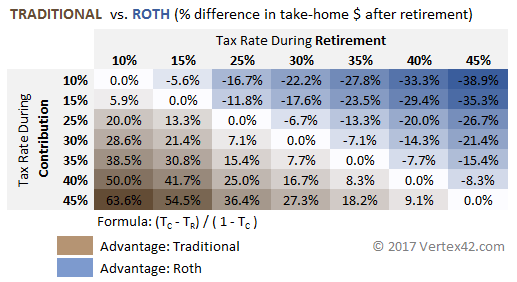

The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. The maximum roth 401 k contribution limit will remain the same as last year in 2021. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay.

Use this calculator to see how increasing your contributions to a 401k can affect your paycheck and your retirement savings. Anything your company contributes is on top of that limit. Build Your Future With a Firm that has 85 Years of Retirement Experience.

Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You. Ad Help Determine Which IRA Type Better Fits Your Specific Situation. You probably know for example.

Those who are 50 years or older can invest 6500 more or 27000. State Date State Federal. If youve thought for even a few minutes about saving for retirement chances are you have some familiarity with the 401k savings plan.

Retirement Calculators and tools. Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo. Plan For the Retirement You Want With Tips and Tools From AARP.

Contributions made to the plan are deducted from taxable income so they reduce. When you make a pre-tax contribution to your. Build Your Future With a Firm that has 85 Years of Retirement Experience.

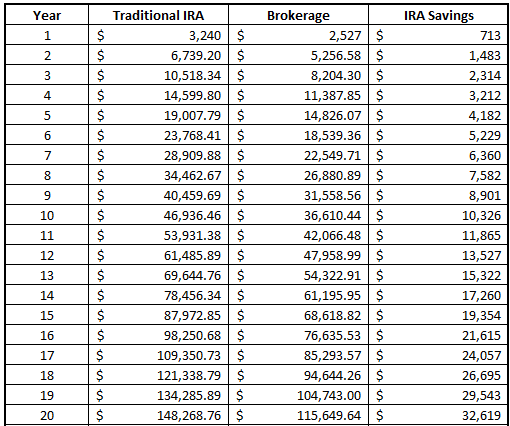

Select a state to. Choose the appropriate calculator below to compare saving in a 401 k account vs. Individual 401 k Contribution Comparison.

Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Microsoft Apps

What Is The Best Roth Ira Calculator District Capital Management

401k Contribution Calculator Amazon Com Appstore For Android

Tax Saving Strategies Tax Savings Calculator Fisher 401 K

401 K Calculator See What You Ll Have Saved Dqydj

Retirement Services 401 K Calculator

Tax Saving Strategies Tax Savings Calculator Fisher 401 K

Download 401k Calculator Excel Template Exceldatapro

Traditional Vs Roth Ira Calculator

401k Calculator

6 401k Calculator Templates In Xls Free Premium Templates

Free 401k Calculator For Excel Calculate Your 401k Savings

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Roth Vs Traditional 401k Calculator Pensionmark