401k paycheck impact calculator

SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

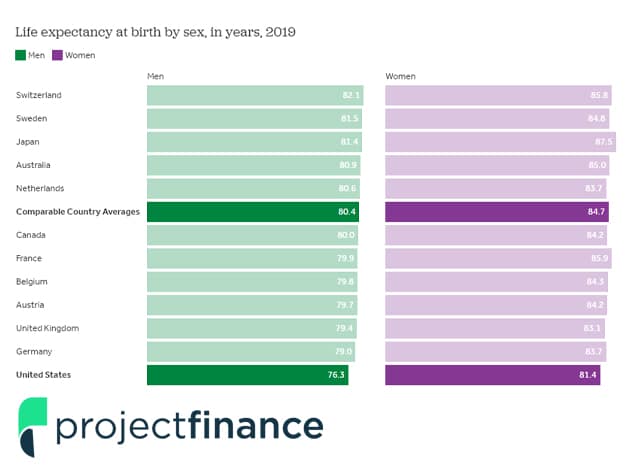

A small change to your paycheck can mean a big impact to your retirement savings.

. Your employers 50 match is limited to the first 6 of your salary then limits your employers contribution to 3000 on a. For example lets assume your employer. When you make a pre-tax contribution to your.

Do NOT include any employer match or your spousepartners employer-sponsored plan. We encourage you to talk to an. This is the maximum percent of your salary matched by your employer regardless of the amount you decide to contribute.

Roth 401 k contributions allow. Are for retirement accounts such as a 401k or 403b. Your employers 50 match is limited to the first 6 of your salary then limits your employers contribution to 3000 on a.

This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. Find out how much you should save using NerdWallets 401k Calculator. IRS Tax Withholding Estimator.

This calculator has been updated to. The accuracy or applicability of the tools results to your circumstances is not guaranteed. You can enter your current payroll information and deductions and then.

Retirement Calculators and tools. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. With a 50 match your employer will add another 750 to your 401 k account.

Use this calculator to help you determine the impact of changing your payroll deductions. If you increase your contribution to 10 you will contribute 10000. So if you elect to save.

If you increase your contribution to 10 your annual contribution is 2500 per year. Calculator to Estimate Potential Contribution That Can Be Made to Individual 401K Plans. Use this calculator to see how increasing your.

If you increase your contribution to 10 you will contribute 10000. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Ad Choose Your Plan and Calculate Between Several Options for Tax-Advantaged Savings.

Choose either the percent of your gross salary contribution or your per pay dollar contribution. Use PaycheckCitys 401k calculator to see how 401k contributions impact your paycheck and how much your 401k could be worth at retirement. The output and other information you will see here about the likelihood of various outcomes are.

You only pay taxes on contributions and earnings when the money is withdrawn. Inform your decisions explore your options and find ways to get the most from your 401k 401k Contribution Calculator Contributing to your workplace. You only pay taxes on contributions and earnings when the money is withdrawn.

Traditional 401 k and your Paycheck. Ad Compare Prices Find the Best Rates for Payroll Services. Your 401k plan account might be your best tool for creating a secure retirement.

As of January 2006 there is a new type of 401 k contribution. A 401 k can be an effective retirement tool. Make Your Payroll Effortless and Focus on What really Matters.

This calculator is provided only as a general self-help tool. Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings. Plus many employers provide matching contributions.

401 K Calculator Paycheck Tools National Payroll Week

How To Calculate Your Roth Ira And 401k Paychecks

Solved W2 Box 1 Not Calculating Correctly

Advanced Paycheck Tax Calculator By Ryan Soothsawyer

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

Paycheck Calculator For Excel Paycheck Payroll Taxes Pay Calculator

Free 401k Calculator For Excel Calculate Your 401k Savings

401 K Plan What Is A 401 K And How Does It Work

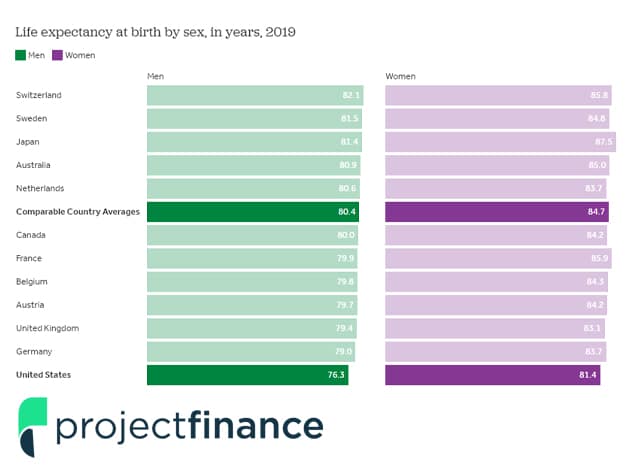

Give Your Retirement Savings A Boost New York Retirement News

401k Contribution Impact On Take Home Pay Tpc 401 K

Roth 401k Roth Vs Traditional 401k Fidelity

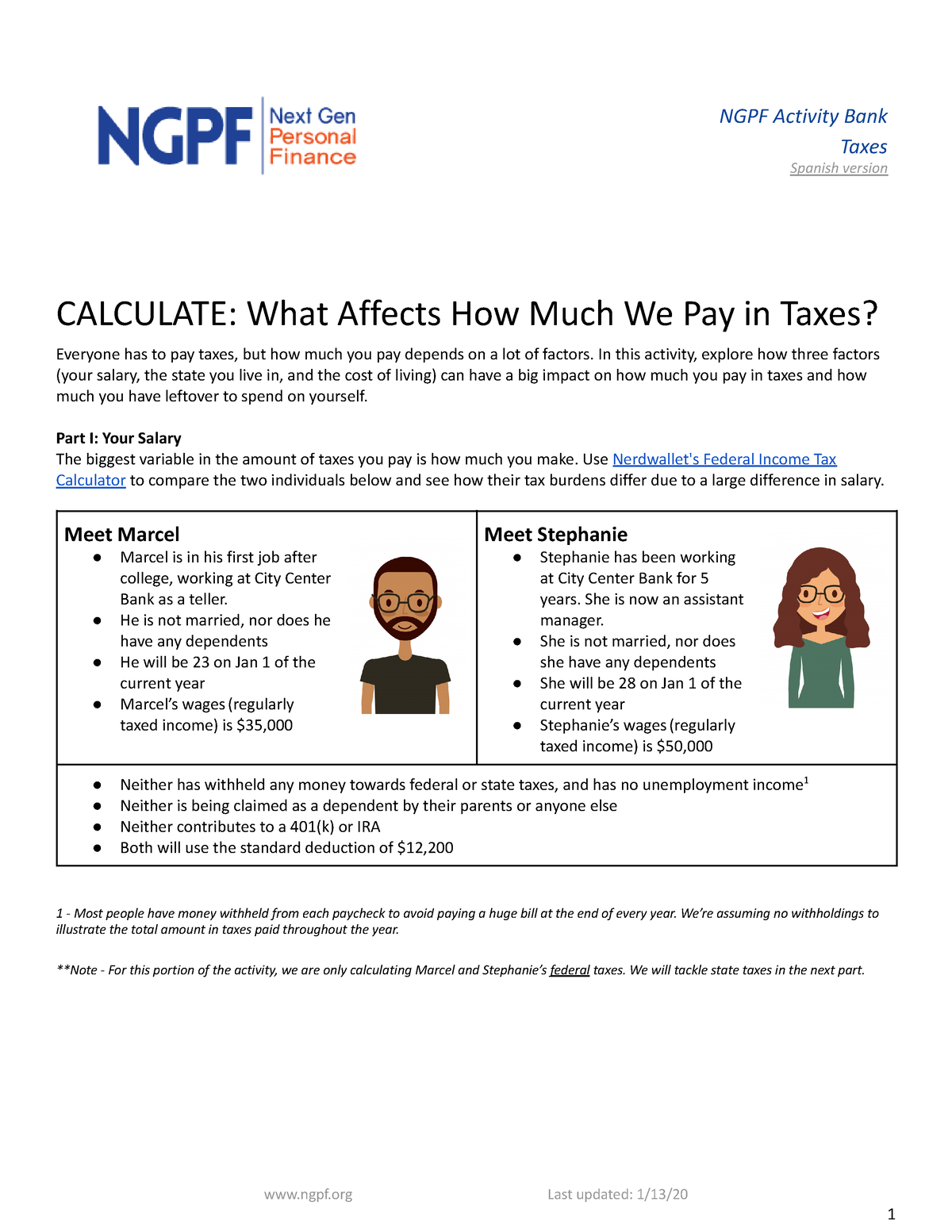

Devs Copy Of A Copy Of Calculate What Affects How Much We Pay In Taxes Ngpf Activity Bank Taxes Studocu

Microsoft Apps

How To Calculate Your Roth Ira And 401k Paychecks

Us Paycheck Calculator By Queryaide

401k Contribution Impact On Take Home Pay Tpc 401 K

401k Calculator